-

Lesson 8.1 - Multinational Accounting - Foreign Currency Transaction

-

Lesson 8.2 - Exchange Rates - Direct and Indirect Exchange Rate

-

Lesson 8.3 - Changes in Exchange Rates

-

Lesson 8.4 - Foreign Currency Transaction

-

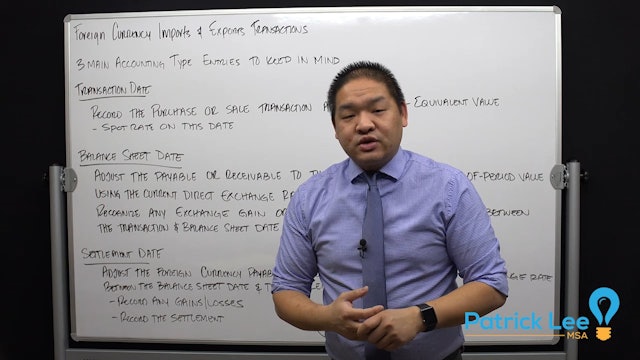

Lesson 8.5 - Foreign Currency Imports & Exports Transactions

-

Lesson 8.6 - Example - Foreign Purchase Transaction - Receivables and Payables

-

Lesson 8.7 - Managing an Exposed Net Liability Position Headging

-

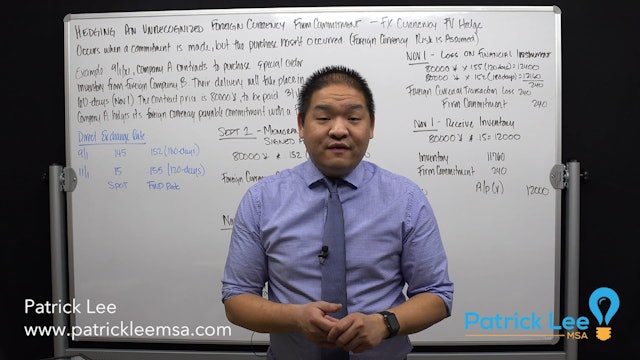

Lesson 8.8 - Hedging an Unrecognized Foreign Currency Firm Commentment - FX Currency - FX Hedge

-

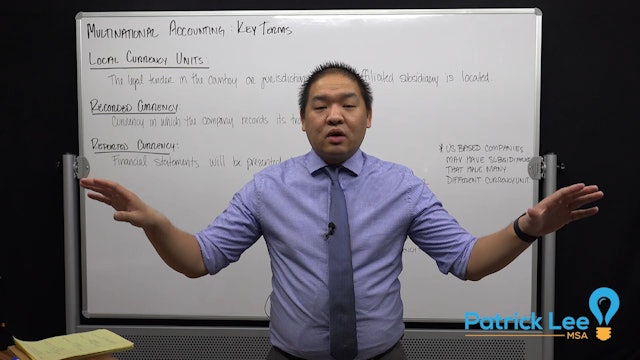

Lesson 8.9 - Multinational Accounting - Key Terms

-

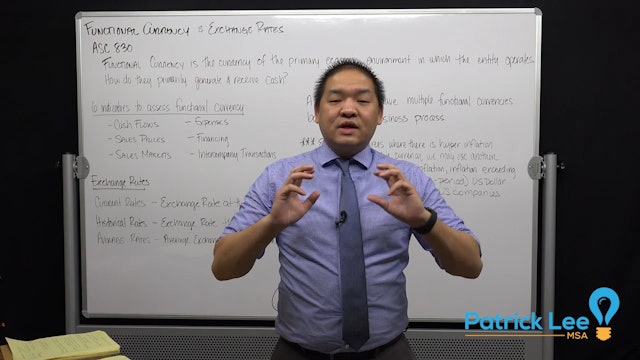

Lesson 8.10 - Functional Currency & Exchange Rates

-

Lesson 8.11 - Translation vs Remeasurement

-

Lesson 8.12 - Example - Translatio & Consolidation of Foreign Subsidiary - Date of Acquisition

-

Lesson 8.13 - Foreign Subsidiary - Consolidated Entries AC - Date of Acquisition

-

Lesson 8.14 - Subsidiary's Foreign Currency Units

-

Lesson 8.15 - Translation of Foreign Subsidarys Trial Balance

-

Lesson 8.16 - Foreign Subsidiary - Parent's Equity Method Entires - End of Year 1

-

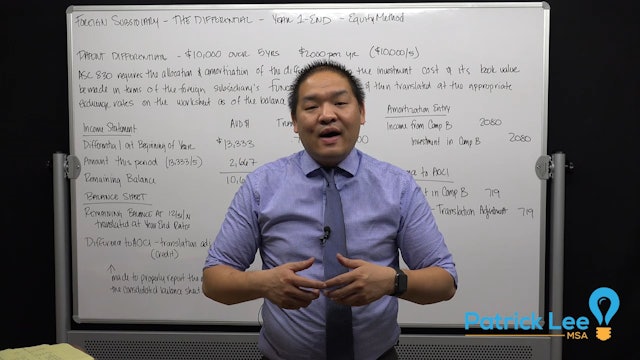

Lesson 8.17 - Foreign Subsidiary - The Differential - End of Year 1 - Equity Method

-

Lesson 8.18 - Foreign Subsidiary - Consolidation of Foreign Subsidary - Consolidation Entries - End Year 1

-

Lesson 8.19 - Review - Remeasurement of the Books of Records into the Functional Currency

-

Lesson 8.20 - Restatement of Foreign Subsidary's Trail Balance - End of Year 1